to a bank that doesn’t invest in fossil fuels

Important Disclaimer: We are not offering ‘financial advice’. We do not earn commission or take rewards for recommending products or services.

Our primary goal is to provide unbiased information to help you make informed decisions.

Why?

The great majority of current fossil fuel reserves must remain unburned if catastrophe is to be avoided. Yet oil, coal and gas companies have infrastructure already in place to extract three times that amount and are investing billions of dollars to find and extract even more.

Most banks lend your money to support fossil-fuel developments.

Most banks lend your money to support these fossil-fuel developments, but there are some that don’t. By moving your money from a bank that lends to fossil fuel companies to one that doesn’t, you can reduce the ability of these banks to lend to large oil, coal and gas producers. The same applies to moving investments/ pension funds out of fossil fuel extraction and ideally, into ‘green’ funds. Many have done so, from the Church of England to the Intensive Care Society; from over 100 UK Universities to the Wellcome Trust.

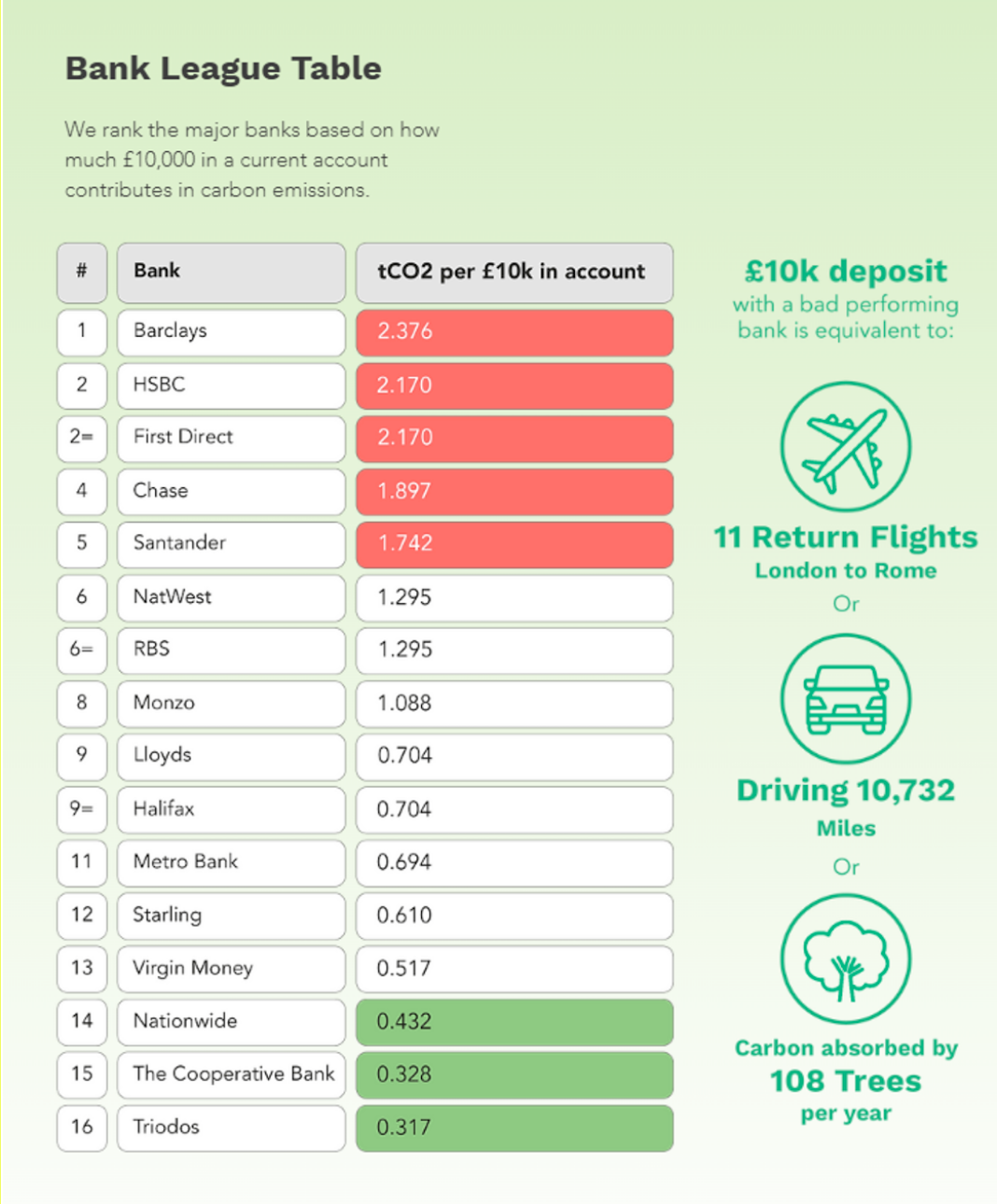

According to Which? magazine, six of the most well-known banks are responsible for $853bn of fossil fuel investment between 2016-22, but alternatives exist (see table below).

£10K deposit in a bank that invests in fossil fuels is the equivalent of driving 10,732 miles across the world in carbon emissions.

It’s easy to move your bank account. It costs nothing (indeed, some banks offer an incentive to move). It’s easy (taking only 20 minutes or so). It’s also painless: all your direct debits etc safely move too.

If you are a business, MotherTree offer a switching service. You can apply for this on their website

For individuals, Which? list the greenest banks as the following, each of whom have a switching process supported by the current account switch guarantee

Nationwide has excellent customer service ratings and, as a Building Society, you become a part owner.

The Co-operative Bank is perhaps the longest-standing ‘ethical bank’ in the UK.

Triodos Bank invests heavily in things that are good for society, as well as not investing in harm.

Zero - the sustainable money app will help you understand and improve your environmental impact